Higher education opens doors to better career opportunities, personal growth, and national development. However, for many students, the cost of pursuing university or college education can be overwhelming. Tuition fees, accommodation, meals, learning materials, and other expenses often exceed what families can afford. In Tanzania, the Higher Education Students’ Loans Board (HESLB) plays a crucial role in bridging this financial gap by offering loans to eligible students.

To benefit from this support, every applicant must understand how the HESLB Account works. This online platform is the foundation of the loan application process, from registration to approval and even repayment tracking. Many students miss out on funding not because they are unqualified, but because they fail to use the system correctly. This blog post explains everything you need to know to improve your chances of successfully securing a student loan.

HESLB Account Overview and Its Importance

The HESLB Account is an online portal designed to manage all student loan activities. It allows applicants to submit loan applications, upload documents, receive notifications, and check their loan status. Essentially, it serves as your personal connection to HESLB throughout your academic journey.

This account is important because HESLB no longer relies on physical paperwork. Every detail used to assess your eligibility is drawn from the information you provide online. If the information is incomplete or incorrect, your application may be delayed or rejected. Proper use of this platform ensures transparency, efficiency, and fairness in loan allocation.

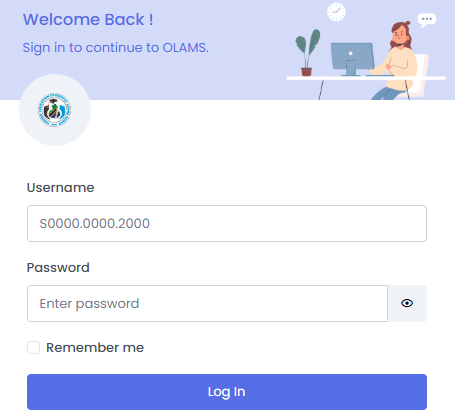

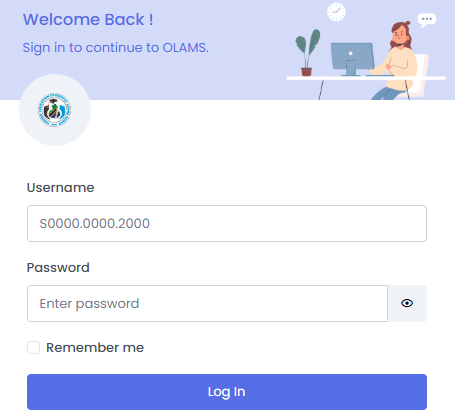

HESLB Account Registration Process Explained

Creating an account is the first step toward accessing a student loan. Registration is done through the official HESLB Online Loan Application System (OLAS). Applicants are required to provide accurate personal details such as full names, date of birth, and National Identification Number (NIN).

Once registration is complete, you receive login credentials that allow access to your dashboard. It is important to keep this information secure, as you will need it not only during application but also in later years to track loan disbursements and repayment obligations.

One common mistake students make is registering multiple accounts. This can lead to confusion in the system and may result in disqualification. Always ensure that you use one account and keep your login details safe.

HESLB Account Required Documents and Information

To complete your loan application, you must upload several documents through your account. These documents help HESLB verify your identity, academic qualifications, and financial need.

Typical requirements include a birth certificate, national ID, academic certificates, admission letter from a recognized institution, and bank account details. Some students may also need to provide parental or guardian information for financial assessment.

All documents should be clear, readable, and correctly formatted. Poor-quality scans or missing documents are among the most common reasons applications are returned for correction. Taking time to prepare these files properly can save you from unnecessary delays.

HESLB Account Common Mistakes Students Should Avoid

Many applicants fail to secure loans due to avoidable errors. One major mistake is providing information that does not match official documents, such as name spellings or dates of birth. Even small inconsistencies can cause verification issues.

Another mistake is ignoring instructions within the application system. Each section contains guidance that should be followed carefully. Skipping steps, leaving sections incomplete, or submitting without reviewing your information can reduce your chances of success.

Missing deadlines is also a serious issue. The account clearly displays application timelines, and late submissions are usually not considered. Regularly logging in helps you stay informed and avoid last-minute problems.

HESLB Account Monitoring Application Status and Disbursement

After submitting your application, the work does not stop. The HESLB Account allows you to track the progress of your application in real time. You can see whether it is under review, approved, or requires corrections.

If approved, the account provides details about loan allocation, including tuition fees, accommodation, meals, and other covered costs. It also shows when funds are expected to be disbursed, helping students plan their finances.

For continuing students and graduates, the same account is used to monitor loan balances and repayment schedules. Understanding this information early encourages responsible financial planning and compliance with repayment obligations.

HESLB Account Tips to Improve Loan Approval Chances

To improve your chances of approval, accuracy is key. Always double-check your information before submission and ensure that all documents are uploaded correctly. Apply as early as possible to allow time for corrections if needed.

Stay active on your account by checking messages and notifications frequently. If HESLB requests clarification or additional information, respond promptly. Most importantly, be honest. HESLB has verification systems in place, and false information can lead to permanent disqualification.

Securing a higher education loan is a significant step toward achieving academic and career goals, and the process begins with proper use of the HESLB Account. This platform is not just a formality but a critical tool that determines whether you receive financial support.

By understanding how the system works, preparing the right documents, avoiding common mistakes, and monitoring your application closely, you greatly increase your chances of success. When used responsibly, the HESLB system empowers students to focus on their studies rather than financial stress.

Treat your HESLB Account with seriousness, accuracy, and commitment, and it will serve as a reliable partner in your educational journey.

READ ALSO: Best List of 6 Diploma Courses With High Priority in Loan Allocation

Leave a Reply